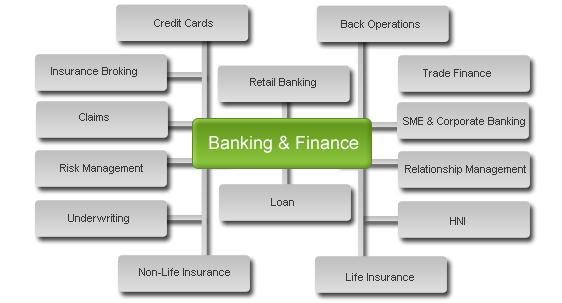

Finance / Banking / Insurance

We have a good experience in this industry

Banks in India are not only strong but are also growing fast. According to studies, Finance & Banking sector is one of the fastest growing sectors in the country. This growth has brought many opportunities.

According to the Indian Banks’ Association Report, the presence of global players in the Indian financial system is likely to increase and simultaneously some of the Indian banks would become global players in the coming years. Allied to the Banking Industry, India’s financial services sector will enjoy generally strong growth during coming years, driven by rising personal incomes, corporate restructuring, financial sector liberalization and the growth of a more consumer-oriented, credit-oriented culture. This will lead to increasing demand for financial products, including consumer loans (especially for cars and homes). Large amount of savings are likely come to the capital markets through direct investments in equities or money flows through mutual funds as well as through insurance and pension products. Hence, there is a crying need for a large pool of New Age professionals with a good understanding of the functioning of equities, commodities and derivatives.

The banks will require a large number of people trained not only for specific skills in the banking domain but more importantly in customer service skills, selling skill, banking application software skills and an infectious positive attitude. In short, a modern banking professional for the modern banking sector is the need of the hour.

India’s Insurance sector has come full circle from being an open competitive market to nationalization and back to a liberalized market again. With the recent changes in the regulatory guidelines, the industry is maturing. Many private sector insurance players have broken even and moved to profits. Powered by an economy which is slated to grow at 7% to 9% and the fact that India is under-penetrated in insurance, this industry is also expected to have a healthy growth of over 15% in the next 3 to 4 years. The industry will witness extensive action to reach to large untapped markets and launch innovative products thus paving way for more trained insurance manpower.